[ad_1]

Newest FCA knowledge has revealed that 300 newly-authorised corporations didn’t survive their first 12 months and almost 3,000 agency didn’t make it to their fifth 12 months.

The figures, analysed by Autus Knowledge Companies, present a excessive fee of attrition fee of corporations.

Regardless of this the variety of people working in FCA-authorised corporations grew by greater than 3,000 over the previous six months to just about 228,000, suggesting appreciable progress in recruitment.

Over the identical interval the variety of energetic corporations fell by 1.1% to 80,925 implying consolidation is resulting in extra folks working for bigger corporations.

Total 5,320 corporations joined the FCA register in H2 2022 whereas 7,481 turned de-authorised, in accordance with FCA register knowledge analysed by Autus.

The period of the one-man band will not be over but, nonetheless. Greater than 36,000 corporations nonetheless have a single registered particular person (RI).

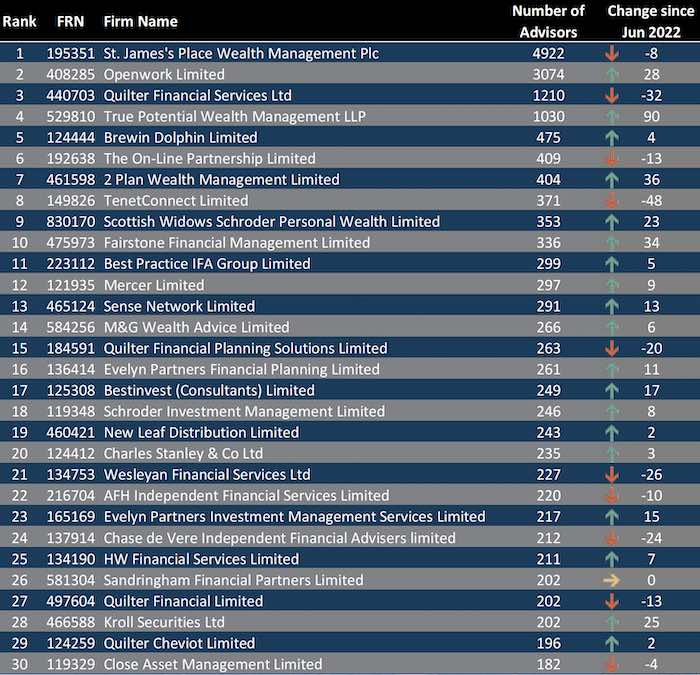

The info revealed that St James’s Place stays the UK’s largest wealth supervisor / Monetary Planner with adviser numbers nearing 5,000 (4,922). Regardless of its dimension, the variety of SJP adviser fell by 8 in comparison with six months in the past though the variety of RIs rose suggesting extra head workplace RI roles.

SJP’s nearest rival when it comes to adviser numbers is Openwork which has 3,074 which had a rise in adviser numbers of 28. Quilter is third with 1,210 (down 32) adopted by True Potential Wealth Administration with 1,030 (up 90) and Brewin Dolphin a great distance behind with 475 (down 4).

True Potential had the most important enhance in adviser numbers within the wealth administration sector, including 90 in H2 2022. Tenet Join continued to contract in dimension with a web discount of 48 whereas Quilter Monetary Companies diminished by 32 following a lower of 140 in H1 2022.

Supply: Autus Knowledge Companies

Different key adjustments proven within the research:

- There are at the moment 38,337 people licensed to supply funding recommendation and 35,324 licensed to advise on mortgages. Of those, almost 9,000 are licensed for each funding and mortgage recommendation.

- Greater than 4,000 folks moved agency within the final 6 months. Some 928 of these moved from one recommendation agency to a different and 626 from one mortgage agency to a different.

- 12,935 joined the Register/Listing for the primary time in H2 2022

Andy Marson, managing director, operations, at Autus stated: “The variety of funding advisers has elevated by round 4,000 within the final 12 months whereas the variety of mortgage advisers has stayed virtually the identical. This demonstrates an growing need for corporations to satisfy the wants of an ageing inhabitants who typically want recommendation greater than ever, notably as particular person pension pots change into extra prevalent than remaining wage schemes for folks in center age.

“With over 4,000 people shifting agency – almost 12,935 becoming a member of the Register/Listing for the primary time and 14,740 leaving it in H2 2022 alone – it’s clear that the rate of change isn’t slowing down regardless of the unsure instances for each funding and mortgage markets over that interval.

“Of the corporations that turned de-authorised in H2 2022 over 300 had been authorised for lower than 12 months and almost 3,000 of them had been authorised for lower than 5 years. This reveals that the enterprise setting stays troublesome for a lot of organisations as they wrestle to take care of the various challenges confronted.”

[ad_2]

Leave a Reply