[ad_1]

Bestinvest’s bi-annual Spot the Canine report, which names and shames poorly performing funds, has revealed that traders are paying £115m in charges a 12 months to put money into 31 ‘canine’ funds.

The agency, a part of Evelyn Companions, estimates that the 31-strong pack of canine funds is incomes virtually £115 million in annual charges primarily based on their present measurement and annual ongoing prices.

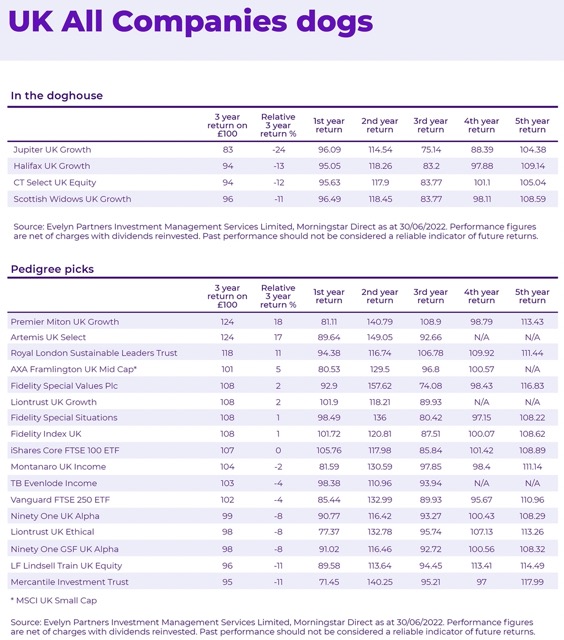

The canine funds embrace a number of giant funds broadly held by traders: Halifax UK Development, Halifax UK Fairness Revenue and Scottish Widows UK Development. Every of those funds has over £1bn invested and collectively maintain £6.7bn for traders.

UK firms funds are a number of the worst performers on the record.

Bestinvest says that a number of poorly performing funds have been on the canine record for a very long time so underperformance appears “entrenched and questions have to be requested over their method.”

Jason Hollands, managing director of Bestinvest, stated: “Whereas short-term durations of weak spot may be forgiven, as a supervisor could have a run of unhealthy luck or their type could also be briefly out of vogue, there may be extra regarding elements at work: necessary adjustments within the administration staff; a fund turning into too massive, which could constrain its flexibility or a supervisor straying from a beforehand profitable method.

“Now we have been producing Spot the Canine for almost three a long time in an effort to elevate consciousness of the poor efficiency of many funding funds and to encourage traders to usually test on how their investments are doing and take motion if obligatory. Whereas there may be causes to persevere a little bit longer with a poor performer – corresponding to a change of supervisor or outlook – in different instances it might make sense to change to a distinct fund with a stronger staff and monitor report.”

Bestinvest says that regardless of the poor efficiency of the worst funds and a really troublesome begin to 2022, numerous funds have improved relative to their benchmarks and “left the kennel,” in line with the agency’s newest Spot the Canine report.

Regardless of the enhancements, Bestinvest has recognized 31 funds that meet the factors to be labelled a canine fund though that is fewer than half the 86 funds revealed within the final report, and the quantity of belongings held in dismal performers has dropped considerably from £45.4 billion to £10.7 billion.

The comparatively small variety of canines this time spherical displays two elements of the Bestinvest ‘canine fund’ choice course of. One is that efficiency is measured relative to a benchmark index – so the fund should have underperformed in comparison with the promote it invests in by 5% or extra over a three-year interval. A second filter is that the fund should even have underperformed in three successive 12-month durations on the trot.

Bestinvest says that whereas there are many poor performers during the last three years, a change in fortune for funds investing in undervalued firms, and dividend paying shares, implies that most of the funds that dominated the record in latest editions have escaped this time as a result of a lot stronger relative efficiency within the final a number of months.

Sectors like power, commodities, client staples and healthcare have had a significantly better run of efficiency in comparison with ‘development’ sectors like expertise, communications companies and client discretionary firms that beforehand delivered stellar returns. Lots of growth-orientated funds which have suffered on this most up-to-date 12 months are saved out of the record by their sturdy efficiency within the earlier two years.

Among the many worst performers, the FTF Martin Currie International Unconstrained fund has the ‘accolade’ of being the worst relative performer, with the fund lagging its index by -34% over the three-year interval, turning £100 into £94 over the three years.

Relating to absolute losses, two funds within the record vied for the trophy. The Schroder European Sustainable Fairness fund left traders with £82 for each £100 invested over the three years, undershooting the index by -27%, narrowly edging the Jupiter UK Development fund which decreased £100 to £83 over the identical interval.

UK-focused funds are a number of the worst performers, with funds within the UK All Corporations and UK Fairness Revenue sectors contributing £7.6 billion, or greater than 70%, to the £10.8 billion whole of belongings within the doghouse.

Supply: Bestinvest

The variety of international fairness earnings funds showing on the record has dropped from 14 final time round to zero. Their income-earning mandates dictate low weightings in the direction of development shares (which generally don’t pay a dividend) and the US market extra broadly.

By way of fund teams, Schroders’ own-brand funds are principally absent from the record this time however the FTSE 100-listed asset supervisor is the funding adviser on this version’s greatest funds from HBOS and Scottish Widows: the Halifax UK Development, Halifax UK Fairness Revenue and Scottish Widows UK Development funds.

Jupiter has three canine funds within the record, with £774.7 million beneath administration, decrease than the six funds that appeared final time, however the funds are all totally different to people who appeared within the final overview.

[ad_2]

Leave a Reply